Our Technology

Welcome to our Developer Documentation! Here, you'll find all the necessary information to integrate and work with our comprehensive banking-as-a-service (BaaS) platform. Our platform provides powerful APIs for financial businesses, offering a seamless way to launch, manage, and scale banking services.

Platform

Our platform is designed to provide everything your business needs to offer digital banking and financial services without needing to build and manage the complex infrastructure yourself. We offer APIs for:

Account Origination

Seamlessly onboard new customers.

Core Banking

Access robust banking ledgers and account management.

Store-of-Value

Securely store and manage funds.

Identity Verification

Verify Identity details and maintain KYC compliance.

E-Payments

Enable transactions across various payment rails.

Card Issuing

Create and manage virtual and physical debit and credit cards.

Spend Management

Track, analyze, and control business expenses in real-time.

Loan Origination

Launch unique credit workflows embedded into your client day-to-day touch points.

Reconciliation Frameworks

Built to manage the most complex pricing models across multiple layers (payment rails, client billing, partner networks billing and more..)

RMCP Management

Our proprietary technology [BirdsEye_] keeps your business compliant with real-time anti-money laundering and terrorist financing management.

Accounting Integrations

Build complex workflows for major accounting platforms with a unified interface.

Debit Orders Management

Activate elastic and automated debit order workflows.

Cross-border / Forex Rails

Manage international transactions and remittance efficiently.

Conversational Banking

Add Embedded finance to your LLM Agentic workflows.

Technology Audits

Review your systems and integrate new solutions to support your scaling journey.

Tech Stack

Sava is a deep tech company taking on really complex engineering feats across core banking, card and transactions processing and accounting integrations.

Framework

.Net Core & Go - Go powers are event-driven architecture complimented by .Net Core services where needed with our integration with Access Bank's financial rails.

Test Driven Development

We use TDD to ensure our event logic is to specification with our business logic before releasing changes to production.

Continuous Integration

We use an in-house CI/CD platform to ensure source code and data does not leave South Africa to comply with regulation and ensure changes are tested before release.

API Security

Decentralised JWTs used in conjunction with Nats' security architecture which uses zero-trust JWTs. No private keys are ever shared with the server.

Observability

Frontend observability is provided by Sentry and backend observability is managed by Prometheus and Grafana.

Code Storage

Source code is hosted on github

Event Streaming

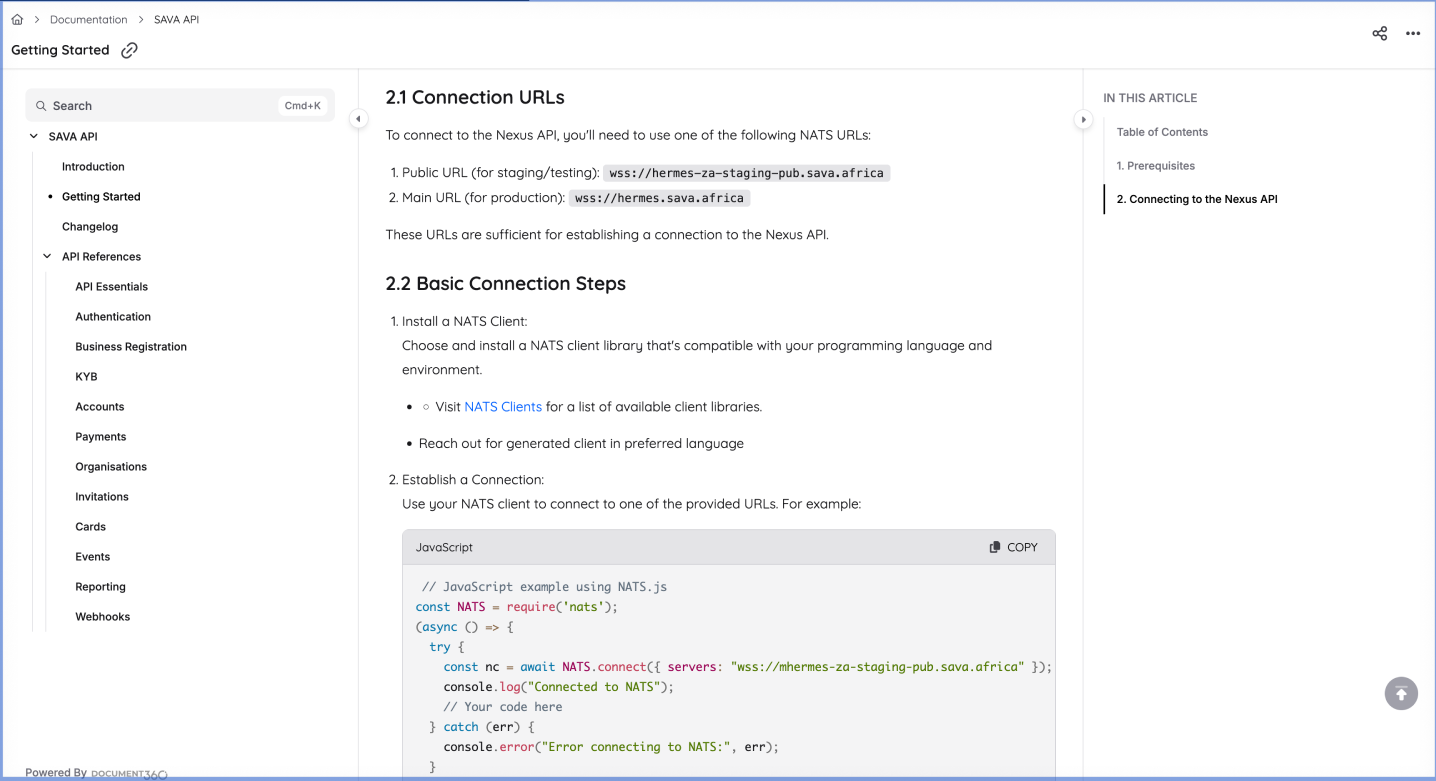

We use Nats' Jetstream capabilities as our event streaming implementation with a minimum of replication factor of 3 to ensure data integrity.

Database

We rely on Nats' Jetstream as well as SQL Server for data storage.

Deployment

Our deployments are managed through Kubernetes allow us to scale resources as needed.

Technical Documentation

Our technical documentation is managed by google drive augmented by Hashicorp Hermes

/Authentication

We use OAuth 2.0 for secure and standardized authentication. You'll need to use your API key as a bearer token for all requests.

/API Overview

Each module in our platform has its own set of endpoints, each tailored to handle specific business functions. Here's a high-level overview:

/Testing Environment

Developers will be provided access to our sandbox environment to fully build out their solution. Once all integrations tests have passed, we will supply production credentials.

Getting Started

To start using our APIs, reach out to us at developers@sava.africa

//Support

For further assistance, reach out to our support team at support@sava.africa or via the developer portal's support section

Empower Your Business with Tailored Banking Solutions

Unlock new revenue streams, improve customer satisfaction, and streamline operations.