Risk and Compliance

Regulations

Sava has been approved by the South African Reserve Bank to offer banking services. This approval was granted after multiple stages of due diligence and preparation. Sava also has the necessary licenses from the FSCA, NCR and the FIC to provide the proposed services. The Sava offering provides our client with a full-suite solution (Licenses, Technology and Risk Management)

Deloitte Audit

Sava has undertaken a successful audit from Deloitte in order to launch our services in SA. This audit covered 30 key areas of the business and value proposition. This audit will be conducted on a yearly basis as Sava grows across the continent.

Partner Bank

Sava has partnered with Access Bank SA to enable our services in SA.

Risk Partners

Sava has partnered with FullStream Business Solutions (FBS), a notable provider of technology and risk management consulting services. With a strong track record in delivering information security projects and services, FBS's experience and knowledge enable us to simplify our clients' complex environments using globally accepted best practices. FBS also provides IT Governance and the required training on ISO 38500, COBIT5, ISO 20000, ISO 27001 and ISO 22301. Sava's integration with Mastercard is also PCI-DSS Compliant.

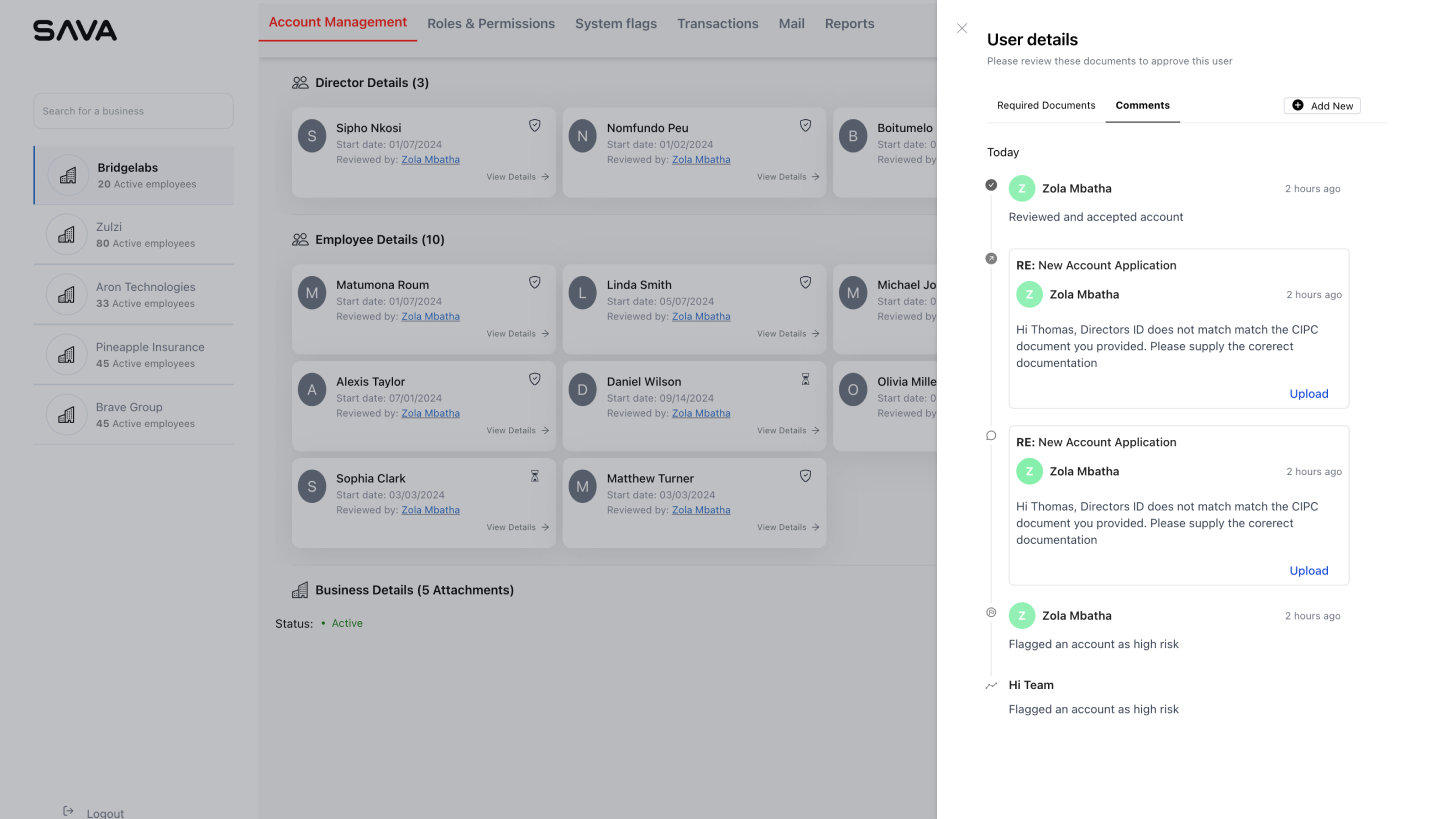

BirdsEye Compliance Platform

We know that compliance isn’t just a requirement – it’s a critical part of building trust and security in financial services. Designed specifically for banking-as-a-service, BirdsEye empowers you to monitor, protect, and manage compliance effortlessly. With BirdsEye, you gain:

Comprehensive Customer Insights

Access real-time data on customer activities to stay informed and proactive.

Advanced Security

Protect key actions with multi-factor authentication, enhancing the security of sensitive operations.

Fraud Detection

Stay vigilant with our fraud vectors database, designed to help identify and mitigate risks early.

KYB/KYC & Transaction Monitoring

Comply with Know Your Business (KYB) and Know Your Customer (KYC) regulations while monitoring transactions seamlessly.

Document Management

Securely store and access essential compliance documents all in one place.

Query Management

Manage and resolve compliance queries with ease, keeping your operations smooth and transparent.

System Status Reports

Receive updates and reports on multiple system statuses to ensure a reliable compliance process.

BirdsEye also offers a library of educational content to help users stay informed and ahead of evolving compliance standards. Empower your business with a platform that prioritizes compliance, security, and innovation.

Empower Your Business with Tailored Banking Solutions

Unlock new revenue streams, improve customer satisfaction, and streamline operations.